The auction market for Pablo Picasso is larger than that for all female artists over the past 14 years.

By Katya Kazakina, senior reporter, Artnet News

Carmen Herrera in her studio, 2015. Photo by Jason Schmidt. © Carmen Herrera, courtesy Lisson Gallery.

Carmen Herrera in her studio, 2015. Photo by Jason Schmidt. © Carmen Herrera, courtesy Lisson Gallery.Artist Carmen Herrera was in her early 90s when her dormant career got an unexpected boost.

Art dealer Nicholas Logsdail spotted her geometric abstract paintings at London’s Latin American art fair Pinta in 2009. Not one had sold when Logsdail offered to show them at his gallery, Lisson.

The rest is history. Over the following decade, Lisson helped turn Herrera into an unlikely market darling, with paintings selling at auction for as much as $3 million each and primary market works topping north of $4 million. Between 2008 and mid-2022, her work generated $19.7 million in auction sales, according to Artnet Price Database. That put her in 54th place among more than 2,000 women artists, according to the Burns Halperin Report, which seeks to track representation in museums and the art market.

But Herrera is the exception rather than the rule. The overwhelming majority of women, especially women of a certain age, are ghosts as far as auction sales go. The reasons for this vary, from the market’s preference for painting over conceptual and performance art to lack of access to the gallery system to individual choices to slow artistic production during child-rearing years.

“The auction market is not the only barometer of success in the art world,” said writer Linda Yablonsky. “I mean Duchamp doesn’t sell that well at auction, and he’s probably the most important artist of the 20th century. Compare Duchamp to Warhol, who wouldn’t have made anything without Duchamp.”

According to the 2022 Burns Halperin Report, women artists account for just 3.3 percent of all fine-art auction sales since 2008. And while most agree these figures are a limited barometer of market traction, they can still have ripple effects on a career—and the dynamic has led some women to chart alternative paths to success.

The Superstar Effect

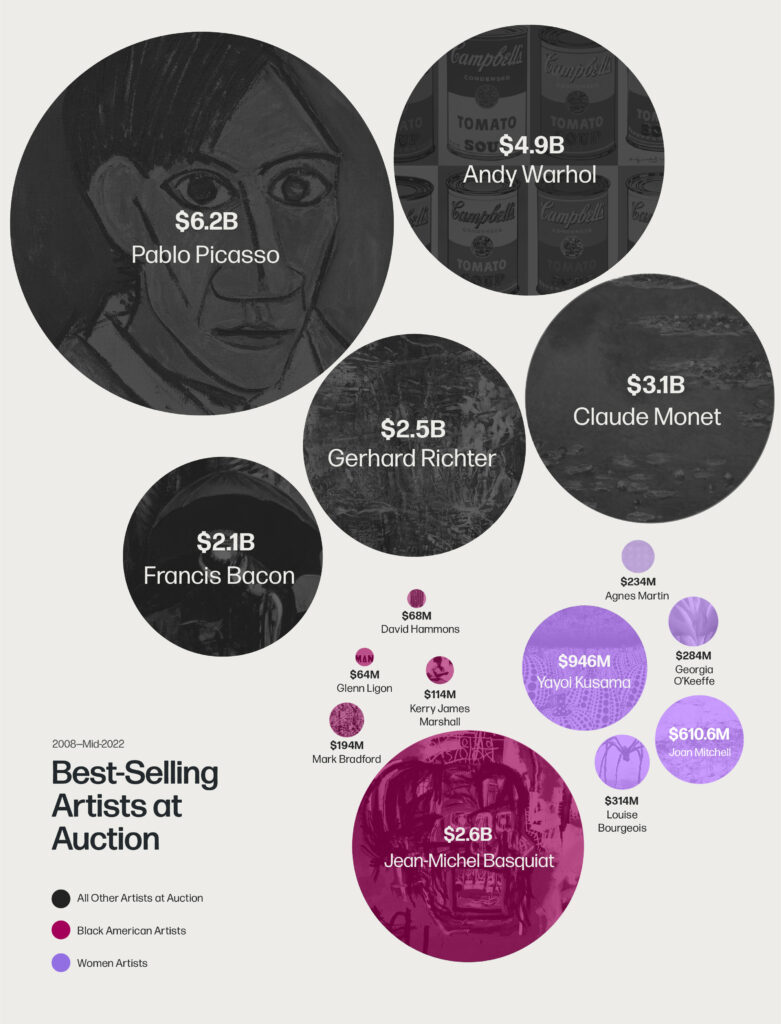

When it comes to female artists, the market’s spoils are disproportionately concentrated at the top. In the auction market at large, the 20 top-selling artists account for 30 percent of the total $187 billion spent on fine art between 2008 and mid-2022.

Meanwhile, just the top five women artists—Yayoi Kusama ($946 million in auction sales), Joan Mitchell ($610.6 million), Louise Bourgeois ($314 million), Georgia O’Keeffe ($284 million), and Agnes Martin ($234 million)—represented around 40 percent of all sales of works by female-identifying artists over the same span.

These are big numbers. But Pablo Picasso’s total auction sales since 2008 reached $6.23 billion, exceeding the combined sales of all female artists in the database by $30 million, according to the Burns Halperin Report.

Beneath the Surface

The gulf between art-historical significance and auction spend becomes increasingly clear further down the list of top-selling female artists. Take Andrea Fraser, a trailblazing performance artist who probes institutional biases and recently joined the blue-chip Marian Goodman gallery. She has a total auction revenue of just $16,145 since 2008, ranking 1,245th.

This result may be due in part to the fact that Fraser, who is widely collected by museums, would not permit private ownership of her work for many years.

“Auctions are not elections,” said Saskia Draxler, co-owner of Nagler Draxler gallery, which has represented Fraser since 1990. “Auction results don’t reflect the state of democracy or civilization, they reflect the taste of a minority, a minority that in the bigger picture isn’t that important.”

Not having an auction market didn’t hurt Fraser’s career, she added. “To the contrary, it increased the credibility of her work, which was intentionally only sold to museums, in order to not make it part of that side of the art world that sees art as a commodity that thrives through speculation, but as a practice with cultural value that enriches the way we think, act, and feel.”

A Missing Piece

Primary-market prices and demand may tell a different story than auction data. And galleries work behind the scenes to build careers through exhibitions, introductions to curators, facilitating sales to museums, and publishing artist books. But collectors entering the market and museums considering acquisitions often use auction prices as a benchmark to determine how much they should pay.

“People are stuck on data, more so than ever,” said art dealer Eric Firestone. “Unfortunately a lot of the commercial market leans on that. But there’s another layer of data: the way collectors, curators, and viewers of art are responding to the work.”

In October, Firestone sold 15 abstract paintings by the late Pat Passlof at Frieze Masters in London, with prices ranging from $50,000 to more than $500,000. Only three works by the American abstract artist ever sold at auction, generating a total of $26,625. A contemporary of Joan Mitchell, she studied painting with de Kooning at Black Mountain College, showed at co-op galleries in New York, and was married to a fellow abstract painter Milton Resnick.

“There’s a market for her work,” Firestone said, adding that he sold an additional 10 paintings by Passlof at Art Basel Miami Beach. “From an auction point of view, you have no data. But at a certain point, connoisseurship comes into play.”

Firestone recently experienced the side effect of little auction data when a collector reneged on a painting priced at $50,000 after discovering that Passlof’s auction record is $16,000.

“If you want to renegotiate the price, we’ll consider it,” Firestone said the person told him. “I could have sold it 10 times in Miami. It’s just bad form.”

© Martha Edelheit / Artists Rights Society (ARS), New York.

The Numbers Game

Pricing works by overlooked artists isn’t a perfect science. While he’s establishing Passlof’s market, Firestone puts her in conversation with historic work, like a Mitchell of similar quality. “Those people who are spending that kind of money, they know what’s out there for other female AbEx painters who are her contemporaries,” he said.

When Lisson began working with Herrera, there was no market for her work, either, said Alex Logsdail, the gallery’s chief executive officer. Prices started at $50,000 and topped out at $250,000. These same works would now command $4.5 million at the gallery.

Markets take time to build and it’s a multi-pronged process.

“It’s a combination of museum exposure, of galleries doing due diligence and bringing forward these forgotten artists, and of scholars writing about them,” said Darsie Alexander, the chief curator at New York’s Jewish Museum, which included several overlooked female Pop artists in its current exhibition “New York: 1962–1964.”

“Museums play an important role but it’s just one part of the larger enterprise,” she said. “It’s never just one thing. The market has to be ready for these artists.”

Female collectors are often among the early supporters of female artists. Tattooed Lady (1962), a playful, shaped canvas of a tattooed woman bent over her knees in the Jewish Museum show by 91-year-old Martha Edelheit, 91, is on loan from Beth Rudin DeWoody, whose collection includes many works by overlooked women. Edelheit was an active member of the 1960s and ‘70s New York scene, but hasn’t had much market recognition. None of her works has appeared at auction, according to the Artnet Price Database.

“If a museum suddenly decides to show one of these female artists, people will see the work in a different light,” Rudin DeWoody said. “I want to highlight them so that people see them and say, ‘Hey, look at that!’”

You can read all the articles in the 2022 Burns Halperin Report here.